- victims of john wayne gacy jr.

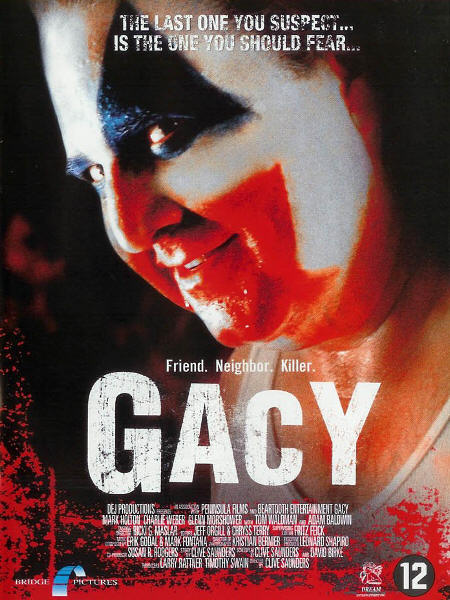

- john wayne gacy clown john

- pictures John Wayne Gacy oil

- Clown John Wayne Gacy?

- hairstyles john wayne gacy

- John+wayne+gacy+clown

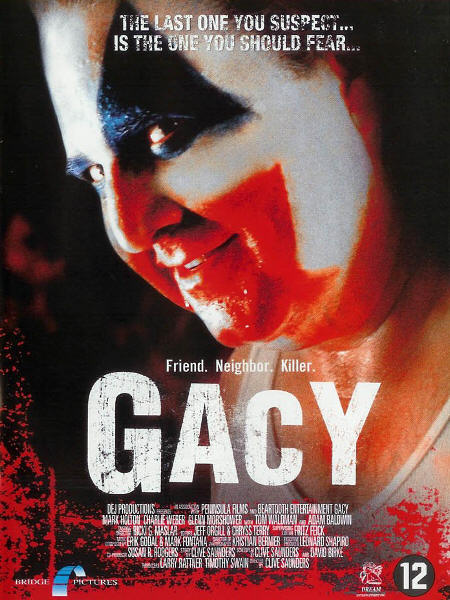

- John Wayne Gacy

- acting strange John Wayne Gacy

- JOHN WAYNE GACY CLOWN PICTURES

- girlfriend Killer John Wayne

- John+wayne+gacy+clown john

- john wayne gacy clown.

- hair John Wayne Gacy Art For

- john wayne gacy art baseball. john wayne gacy art; john wayne gacy art

- 2011 John+wayne+gacy+clown+

- tattoo John+wayne+gacy+clown

- Clown: john wayne gacy jr.

- 2010 Get Killer Clown: John

- tattoo John Wayne Gacy,

images acting strange John Wayne Gacy

wallpaper victims of john wayne gacy jr.

2011 john wayne gacy clown john

more...

more...

2010 pictures John Wayne Gacy oil

more...

hair Clown John Wayne Gacy?

more...

hot hairstyles john wayne gacy

more...

house Clown: john wayne gacy jr.

tattoo John+wayne+gacy+clown

more...

pictures John Wayne Gacy

dresses john wayne gacy clown.

more...

makeup JOHN WAYNE GACY CLOWN PICTURES

girlfriend john wayne gacy art baseball. john wayne gacy art; john wayne gacy art

hairstyles John+wayne+gacy+clown john

Source URL: http://cyclistatlarge.blogspot.com/2011/06/john-wayne-gacy-clown-costume.html

Visit amy winehouse for Daily Updated Hairstyles Collection

ronhira

09-26 11:55 PM

--------------

Thanks for your post and the "dignified" language of your criticism. In a public forum it is impossible to expect everyone to talk in the same voice. Dissent in inevitable. If you are a staunch supporter of the EB3 cause, it is your prerogative, but you cannot expect every EB2 person to fall in line with your thoughts and call them traitors. Is it a sin for EB2 people to join together and protect their interests and represent their case? Is it not democratic? What way is it inflammatory or legally wrong? I am only asking those EB2 people who feel that they would be affected to ponder over the impact of a re-interpretation. There is a legal avenue to port from EB3 to EB2. Eligible EB3 folks can certainly port to EB2 and get benefited.

A few EB2 and EB3 folks have spoken logically about working unitedly towards visa recapture. No one seems to listen. I am willing and keen to support the visa reacpture. That is a positive approach. However, if reinterpretation is the only route EB3 friends are interested in, then EB2 folks will have to rethink on their approach to the issue. Like it or not, that is the reality.

in case u did not read... i did not call you traitor..... you called yourself a traitor...... i simply called you a$$.......

eb2 v/s eb3 fight has nothing to do with democracy.... it has nothing to do with doing some thing legal or illegal either..... but it has everything to do with dividing people with the same goal.... and making people fight ...... its bullshit..... and that's y u r an a$$.....

u r not a spokesperson for eb2...... so don't act like one..... you are just an a$$.....

people r smarter than u think...... and u r still an a$$......

Thanks for your post and the "dignified" language of your criticism. In a public forum it is impossible to expect everyone to talk in the same voice. Dissent in inevitable. If you are a staunch supporter of the EB3 cause, it is your prerogative, but you cannot expect every EB2 person to fall in line with your thoughts and call them traitors. Is it a sin for EB2 people to join together and protect their interests and represent their case? Is it not democratic? What way is it inflammatory or legally wrong? I am only asking those EB2 people who feel that they would be affected to ponder over the impact of a re-interpretation. There is a legal avenue to port from EB3 to EB2. Eligible EB3 folks can certainly port to EB2 and get benefited.

A few EB2 and EB3 folks have spoken logically about working unitedly towards visa recapture. No one seems to listen. I am willing and keen to support the visa reacpture. That is a positive approach. However, if reinterpretation is the only route EB3 friends are interested in, then EB2 folks will have to rethink on their approach to the issue. Like it or not, that is the reality.

in case u did not read... i did not call you traitor..... you called yourself a traitor...... i simply called you a$$.......

eb2 v/s eb3 fight has nothing to do with democracy.... it has nothing to do with doing some thing legal or illegal either..... but it has everything to do with dividing people with the same goal.... and making people fight ...... its bullshit..... and that's y u r an a$$.....

u r not a spokesperson for eb2...... so don't act like one..... you are just an a$$.....

people r smarter than u think...... and u r still an a$$......

wallpaper victims of john wayne gacy jr.

msp1976

02-06 03:59 PM

I am jumping ahead of the situation here, but I just wanted to see what other members think/know. Assuming that the 90K visa recapture happens, It doesnt take too long for them to be used up in the current situation where there are a lot of people with labors and approved 140's (w/PERM). Not every one will have an oppurtunity to file for a new labor and file for 485. If DOS makes the PD's current / post Mar 2005, wouldn't it be unfair to people who labors are pending for 3 yrs. How does this work out in the previous recapture? HLG doesnt say about numbers being forwarded to the next year though.

HLG wants to give these 90 K to the healthcare professionals Schedule A only...So I donot know about you but I donot get anything for sure.....Even if the recapture is for all categories it would not make much difference....May be EB3 ROW would become current...and EB2 India dates would move a bit....

HLG wants to give these 90 K to the healthcare professionals Schedule A only...So I donot know about you but I donot get anything for sure.....Even if the recapture is for all categories it would not make much difference....May be EB3 ROW would become current...and EB2 India dates would move a bit....

gc_wannabe

08-04 01:43 PM

My online status (and my wife's) changed from "Initial review" to "Card/ Document Production". Is this where the road ends?

My PD is 02/14/2006. I-485 receipt date was Oct-2007.

Thanks.

My PD is 02/14/2006. I-485 receipt date was Oct-2007.

Thanks.

2011 john wayne gacy clown john

sands

07-21 04:02 PM

E-Filed - May 12

finger printing May 31

No update after that.

finger printing May 31

No update after that.

more...

spicy_guy

07-14 11:38 AM

EB3 Other workers has the most wait time compared to EB3 general. So by your logic people who are waiters, chef, janitors and farm workers should get the greecards before you. :D

And what will happen if CIR passed. All 13 million will be in a category that will be most backlogged. Should they get all greencards before you?

Well, thats spillover... Its not that USCIS is going to allocate more visas for EB3 or more Visas. So spillover, yes!

And what will happen if CIR passed. All 13 million will be in a category that will be most backlogged. Should they get all greencards before you?

Well, thats spillover... Its not that USCIS is going to allocate more visas for EB3 or more Visas. So spillover, yes!

paskal

09-19 07:10 PM

this is not just a question of depriving those who did not come.

let's please recognise that many people did have genuine compulsions as well.

the more important issue at hand is that sensitive information should not be released on an open forum. state chapters are free to organize live meetings and brief their members on lawmaker meeting experiences. those who attend chapter sessions are welcome to participate and learn- and join in for future meetings which should continue at the district/state level.

let's please recognise that many people did have genuine compulsions as well.

the more important issue at hand is that sensitive information should not be released on an open forum. state chapters are free to organize live meetings and brief their members on lawmaker meeting experiences. those who attend chapter sessions are welcome to participate and learn- and join in for future meetings which should continue at the district/state level.

more...

abhijitp

07-25 08:26 PM

Unfortunately your friend is correct - the alternate I can think is withdraw your present application and file I-140 and I-485 simultaneously now - other please tell whether this will be a good approach for their benefit. Can EB3 file concurrently I 140 and I 485.

But how to revoke an already submitted I-140 Eb-2?

By the way, many a time such a case would be issued an RFE and then you could change (not aware of the exact terminology for this) it to Eb-3.

But how to revoke an already submitted I-140 Eb-2?

By the way, many a time such a case would be issued an RFE and then you could change (not aware of the exact terminology for this) it to Eb-3.

2010 pictures John Wayne Gacy oil

WeldonSprings

04-30 10:01 AM

Hello All,

I e-Filed my EAD at the Nebraska Service Center (NSC).

E-Filed on 04/15/10

Documents received by NSC on 04/16/10 and had a LUD.

Additional LUDs on 04/19/10 and 04/20/10

But after that no news.

Is anybody in the same boat who has e-filed around the same date or have recievd their EAD cards.

[QUOTE=anilkumar0902;1734942]After a little bit of delay and suspense and a number of Soft LUDs...I finally received my renewal EAD today. Hurray !!! It almost feels like receiving a GC.

So, here's the deal:

E-filed for myself and my wife on 03/16

Approved on 04/09

Wife's EAD received on 04/12

Then started all the drama..

A lot of LUDs..but no card for me. The status shows approved ...one day and then Post-processing and then again back to Card-production ordered...Here and there and last week i saw a message saying .."Your new card is sent to your address on file". I must've checked my application at least 10 times before submitting...No issues with the application. But hey...All is well that ends well.

All the best to everyone else too...Always be hopeful and celebrate every good news..

Cheers[/QUOTE

That is good !

What is the duration of your EAD ? (I mean for 1 yr/2yr ?) and Is it effective from the date of approval or from the date on expiration of your current EAD ?. Hopefully, this is your last ead as GC should be on your way soon.

I e-Filed my EAD at the Nebraska Service Center (NSC).

E-Filed on 04/15/10

Documents received by NSC on 04/16/10 and had a LUD.

Additional LUDs on 04/19/10 and 04/20/10

But after that no news.

Is anybody in the same boat who has e-filed around the same date or have recievd their EAD cards.

[QUOTE=anilkumar0902;1734942]After a little bit of delay and suspense and a number of Soft LUDs...I finally received my renewal EAD today. Hurray !!! It almost feels like receiving a GC.

So, here's the deal:

E-filed for myself and my wife on 03/16

Approved on 04/09

Wife's EAD received on 04/12

Then started all the drama..

A lot of LUDs..but no card for me. The status shows approved ...one day and then Post-processing and then again back to Card-production ordered...Here and there and last week i saw a message saying .."Your new card is sent to your address on file". I must've checked my application at least 10 times before submitting...No issues with the application. But hey...All is well that ends well.

All the best to everyone else too...Always be hopeful and celebrate every good news..

Cheers[/QUOTE

That is good !

What is the duration of your EAD ? (I mean for 1 yr/2yr ?) and Is it effective from the date of approval or from the date on expiration of your current EAD ?. Hopefully, this is your last ead as GC should be on your way soon.

more...

breddy2000

01-14 10:07 AM

Wall Street's Rigged Casino

http://www.financialsense.com/fsu/editorials/barry/2009/0113.html

Last year was certainly a turbulent one for investors. Not only did good assets and companies sell off with bad, but the very integrity of the U.S. markets was brought into question. Financial firms spend millions of dollars convincing the average citizen that investing in stocks is necessary and prudent, yet the playing field is far from level. Fraud, naked shorting and other forms of manipulation are now endemic to the American markets. As Overstock's lawyer, John O'Quinn points out, “You have more chance to be treated fairly in a casino in Vegas.” How can you invest if you can't trust the system?

Jim Puplava, Mike Schneider and a few other journalists have exposed the prevalence of naked shorting on Wall Street. While selling short is a legitimate activity, naked shorting occurs when parties sell shares they don't own and don't intend to borrow, causing more shares to be traded than actually exist. Approximately 7.5% of the trades reported by the DTCC fail to deliver each day, and this agency is private and not at all transparent. Furthermore, 96% of all stock transactions are completed outside the official system and are totally unregulated.

Regulation SHO was enacted in 2005 by the Securities and Exchange Commission (SEC) to supposedly eliminate chronic settlement failures by forcing brokers to close out positions after thirteen consecutive trading days. However the regulation doesn't cover small and micro cap companies, or failures to deliver (FTDs) that are below a certain numerical threshold. Market makers were exempt from this regulation until last fall, and old FTDs were allowed to remain open. Some corporations remained on the threshold list for over a year consecutively with no relief from the SEC.

Chairman Cox admitted in July 2006 that there were many large loopholes in Regulation SHO which allowed predatory shorting to continue. Few firms were investigated, and even those brokers who were caught paid minimal fines. Almost nothing was done until naked shorting threatened “the stability of financial institutions,” according to Cox. In July 2008, the SEC banned naked shorting of 19 select financial firms. With this rule and the subsequent emergency order banning all short selling in 799 financial institutions, Cox admitted that naked shorting was a serious problem, but the SEC would only enforce the rules for certain institutions that deserved the effort.

The Commission has demonstrated where its real allegiance lies, and it’s not with the small investor. For years, hedge funds, brokerages, and investment banks soaked up fat profits by naked shorting promising companies to death. These shorts never have to be covered if the company is delisted and goes bankrupt, so it’s a very lucrative criminal practice. When some of these same corporations that preyed on small cap stocks suffered share price drops due to their hideous balance sheets, the SEC moved in to give them special protection.

Even with some of the loopholes closed, market manipulation still goes on. As Allan Young points out on his website, naked shorting is in effect another derivative like credit default swaps or mortgage backed securities. Predatory brokers can sell more shares than exist, as if they are buying a put (a bet that prices will go down). Sell enough shares and you can ensure your bet is correct. These brokers can later close out their naked shorts and avoid censure from the SEC.

Although the most egregious violations of the naked short rules have been eliminated, with corporations like Overstock now off the naked short list, much of the damage has already been done. Many solid businesses have been naked shorted out of existence, leading to unemployment and destruction of wealth for millions of taxpayers. U.S. citizens are angry and scared as they watch their stock portfolios shrink, and see their pensions in jeopardy.

This begs the question as to why the U.S. government would prop the markets up on one hand using the Plunge Protection Team, while allowing naked shorting on the other which pushes the share prices down. I can only conclude that the system is designed to redistribute wealth from small investors to elite bankers and hedge fund managers. Perhaps the stock markets were allowed to decline so the politically connected shorts could cover profitably. With the close relationship between Wall Street, regulators, Congress, and the Treasury Department full of former Goldman Sachs executives, it's clear that the average worker with retirement money invested in the market is at an extreme disadvantage.

The SEC suffered another embarassment with the revelation that Bernard Madoff ran a US$50 billion Ponzi scheme disguised as a hedge fund for several years. Only a tip from Madoff's sons to the FBI unraveled the scheme. In fact, the SEC investigated Madoff's company eight times over more than a decade and failed to find any fraud. A former SEC attorney is now married to Madoff's niece, raising doubts about his objectivity in examining Madoff's books. Even when Harry Markopoulos, a private whistleblower, produced evidence that Madoff's trading results could not be replicated, no one at the SEC took him seriously.

Congress has been quick to blame Commissioner Cox, a former colleague for the Madoff scandal. However, missteps and inadequate enforcement predate Cox, who has only run the SEC since August 2005.

Obama's pick to replace Cox, Mary Schapiro has many flaws of her own. She previously appointed one of Madoff's sons to a disciplinary board, making her judgement look very poor. Schapiro is currently chief of the Financial Industry Regulatory Authority, a self regulating body which has been even less willing than usual to crack down on Wall Street abuses during her tenure. She ran the Commodity Futures Trading Commission (CFTC) under President Clinton, an agency that has been unable or unwilling to perceive the manipulation in the precious metals markets while pursuing collusion in other commodities. Schapiro stated she was inspired to pursue a regulatory career by watching the Hunt brothers' silver moves, so we know where her biases lie.

As an analyst, I spend hours each week poring over balance sheets, and reading financial statements of companies I may want to recommend to my subscribers. My task is made very difficult by the widespread financial fraud. While Madoff's results were too good to be true, other forms of deception are extremely hard to detect. Satyam is the latest scandal to hit Wall Street. Although the corporation is headquartered in India, Satyam has Fortune 500 clients in the U.S. and is listed on the NYSE. It has to comply with Sarbanes-Oxley regulations just like any American company, rules that are supposed to enforce honesty and transparency. Satyam – which is Sanskrit for truth - was awarded the Golden Peacock award for corporate governance just three months ago, in an amazing bit of irony.

With all these scandals, no wonder Merrill Lynch reports that rich customers are demanding gold coins and bars instead of shares in “paper gold” like ETFs. Credible stories indicate that the COMEX warehouses are experiencing record activity as receipt holders seek delivery of their gold. Brokers are apparently attempting to discourage this activity to squelch metal demand. When trust is eroded, people naturally seek safety in an asset without counterparty risk like gold.

If you are a stock investor despite all these perils, how to you separate the wheat from the chaff? First you have to find industries with impeccable fundamentals. While commodities suffered greatly in 2008, I believe they will see a strong rebound in 2009.

Second, check the track record of management and look for any hints of impropriety. Third, read the financial statements and look for unnecessarily complicated structures or conflicts of interest: these are red flags. Fourth, if results seem unbelievably excellent, they may be fictional. Fifth, while you can no longer take delivery of shares in the United States, you can contact the companies you invest in to determine if you are on the list of legitimate shareholders or a victim of naked shorting. Sixth, diversify into several different companies so if one is fraudulent you don't lose all your money. With the danger inherent in stocks, I recommend only investing capital you can afford to lose.

http://www.financialsense.com/fsu/editorials/barry/2009/0113.html

Last year was certainly a turbulent one for investors. Not only did good assets and companies sell off with bad, but the very integrity of the U.S. markets was brought into question. Financial firms spend millions of dollars convincing the average citizen that investing in stocks is necessary and prudent, yet the playing field is far from level. Fraud, naked shorting and other forms of manipulation are now endemic to the American markets. As Overstock's lawyer, John O'Quinn points out, “You have more chance to be treated fairly in a casino in Vegas.” How can you invest if you can't trust the system?

Jim Puplava, Mike Schneider and a few other journalists have exposed the prevalence of naked shorting on Wall Street. While selling short is a legitimate activity, naked shorting occurs when parties sell shares they don't own and don't intend to borrow, causing more shares to be traded than actually exist. Approximately 7.5% of the trades reported by the DTCC fail to deliver each day, and this agency is private and not at all transparent. Furthermore, 96% of all stock transactions are completed outside the official system and are totally unregulated.

Regulation SHO was enacted in 2005 by the Securities and Exchange Commission (SEC) to supposedly eliminate chronic settlement failures by forcing brokers to close out positions after thirteen consecutive trading days. However the regulation doesn't cover small and micro cap companies, or failures to deliver (FTDs) that are below a certain numerical threshold. Market makers were exempt from this regulation until last fall, and old FTDs were allowed to remain open. Some corporations remained on the threshold list for over a year consecutively with no relief from the SEC.

Chairman Cox admitted in July 2006 that there were many large loopholes in Regulation SHO which allowed predatory shorting to continue. Few firms were investigated, and even those brokers who were caught paid minimal fines. Almost nothing was done until naked shorting threatened “the stability of financial institutions,” according to Cox. In July 2008, the SEC banned naked shorting of 19 select financial firms. With this rule and the subsequent emergency order banning all short selling in 799 financial institutions, Cox admitted that naked shorting was a serious problem, but the SEC would only enforce the rules for certain institutions that deserved the effort.

The Commission has demonstrated where its real allegiance lies, and it’s not with the small investor. For years, hedge funds, brokerages, and investment banks soaked up fat profits by naked shorting promising companies to death. These shorts never have to be covered if the company is delisted and goes bankrupt, so it’s a very lucrative criminal practice. When some of these same corporations that preyed on small cap stocks suffered share price drops due to their hideous balance sheets, the SEC moved in to give them special protection.

Even with some of the loopholes closed, market manipulation still goes on. As Allan Young points out on his website, naked shorting is in effect another derivative like credit default swaps or mortgage backed securities. Predatory brokers can sell more shares than exist, as if they are buying a put (a bet that prices will go down). Sell enough shares and you can ensure your bet is correct. These brokers can later close out their naked shorts and avoid censure from the SEC.

Although the most egregious violations of the naked short rules have been eliminated, with corporations like Overstock now off the naked short list, much of the damage has already been done. Many solid businesses have been naked shorted out of existence, leading to unemployment and destruction of wealth for millions of taxpayers. U.S. citizens are angry and scared as they watch their stock portfolios shrink, and see their pensions in jeopardy.

This begs the question as to why the U.S. government would prop the markets up on one hand using the Plunge Protection Team, while allowing naked shorting on the other which pushes the share prices down. I can only conclude that the system is designed to redistribute wealth from small investors to elite bankers and hedge fund managers. Perhaps the stock markets were allowed to decline so the politically connected shorts could cover profitably. With the close relationship between Wall Street, regulators, Congress, and the Treasury Department full of former Goldman Sachs executives, it's clear that the average worker with retirement money invested in the market is at an extreme disadvantage.

The SEC suffered another embarassment with the revelation that Bernard Madoff ran a US$50 billion Ponzi scheme disguised as a hedge fund for several years. Only a tip from Madoff's sons to the FBI unraveled the scheme. In fact, the SEC investigated Madoff's company eight times over more than a decade and failed to find any fraud. A former SEC attorney is now married to Madoff's niece, raising doubts about his objectivity in examining Madoff's books. Even when Harry Markopoulos, a private whistleblower, produced evidence that Madoff's trading results could not be replicated, no one at the SEC took him seriously.

Congress has been quick to blame Commissioner Cox, a former colleague for the Madoff scandal. However, missteps and inadequate enforcement predate Cox, who has only run the SEC since August 2005.

Obama's pick to replace Cox, Mary Schapiro has many flaws of her own. She previously appointed one of Madoff's sons to a disciplinary board, making her judgement look very poor. Schapiro is currently chief of the Financial Industry Regulatory Authority, a self regulating body which has been even less willing than usual to crack down on Wall Street abuses during her tenure. She ran the Commodity Futures Trading Commission (CFTC) under President Clinton, an agency that has been unable or unwilling to perceive the manipulation in the precious metals markets while pursuing collusion in other commodities. Schapiro stated she was inspired to pursue a regulatory career by watching the Hunt brothers' silver moves, so we know where her biases lie.

As an analyst, I spend hours each week poring over balance sheets, and reading financial statements of companies I may want to recommend to my subscribers. My task is made very difficult by the widespread financial fraud. While Madoff's results were too good to be true, other forms of deception are extremely hard to detect. Satyam is the latest scandal to hit Wall Street. Although the corporation is headquartered in India, Satyam has Fortune 500 clients in the U.S. and is listed on the NYSE. It has to comply with Sarbanes-Oxley regulations just like any American company, rules that are supposed to enforce honesty and transparency. Satyam – which is Sanskrit for truth - was awarded the Golden Peacock award for corporate governance just three months ago, in an amazing bit of irony.

With all these scandals, no wonder Merrill Lynch reports that rich customers are demanding gold coins and bars instead of shares in “paper gold” like ETFs. Credible stories indicate that the COMEX warehouses are experiencing record activity as receipt holders seek delivery of their gold. Brokers are apparently attempting to discourage this activity to squelch metal demand. When trust is eroded, people naturally seek safety in an asset without counterparty risk like gold.

If you are a stock investor despite all these perils, how to you separate the wheat from the chaff? First you have to find industries with impeccable fundamentals. While commodities suffered greatly in 2008, I believe they will see a strong rebound in 2009.

Second, check the track record of management and look for any hints of impropriety. Third, read the financial statements and look for unnecessarily complicated structures or conflicts of interest: these are red flags. Fourth, if results seem unbelievably excellent, they may be fictional. Fifth, while you can no longer take delivery of shares in the United States, you can contact the companies you invest in to determine if you are on the list of legitimate shareholders or a victim of naked shorting. Sixth, diversify into several different companies so if one is fraudulent you don't lose all your money. With the danger inherent in stocks, I recommend only investing capital you can afford to lose.

hair Clown John Wayne Gacy?

roseball

08-17 07:00 PM

Applied on May 28, 2010 Electronically

Approved on July 07, 2010.

Now I am working with attorney to file my I-140

I have 3 Years BS Degree in Electronics From Andhra University + 1 Year BS Degree in Computer Specialization from Andhra University.

Still I am kind of tense about my degree is considered as US equivalent degree. It accepted in H1-B, and EB-3 GC process. I am cross my figures until I get the decision from IO. I will give more updates later.

-Sree

Frankly, the chances of getting an EB-2 I-140 approved with your educational background are very bleak to say the least. However, there are always exceptions and I hope you get lucky. Good luck, atleast your employer tried.

Approved on July 07, 2010.

Now I am working with attorney to file my I-140

I have 3 Years BS Degree in Electronics From Andhra University + 1 Year BS Degree in Computer Specialization from Andhra University.

Still I am kind of tense about my degree is considered as US equivalent degree. It accepted in H1-B, and EB-3 GC process. I am cross my figures until I get the decision from IO. I will give more updates later.

-Sree

Frankly, the chances of getting an EB-2 I-140 approved with your educational background are very bleak to say the least. However, there are always exceptions and I hope you get lucky. Good luck, atleast your employer tried.

more...

maristella61

02-02 09:18 AM

It's all that's on my mind now and check this thread every 10 minutes hoping for the best !!!!!!!!!!!!!

Good luck to all and have a great week end!

Good luck to all and have a great week end!

hot hairstyles john wayne gacy

indian111

05-05 10:32 AM

Hi shantak,

I hope I dont get biometric appt as well this time and get the approval directly.

Or else I would have to waste one half day for that.

Hopefully your wifes EAD will also be approved shortly.Keep us posted.

Mine is TSC and yes I got the biometric appointment last time. Also good thing is that this time they have given the start date of from the expiration date of the current EAD.

However as I said im still waiting for my wife's EAD (efiled on the same day)

I hope I dont get biometric appt as well this time and get the approval directly.

Or else I would have to waste one half day for that.

Hopefully your wifes EAD will also be approved shortly.Keep us posted.

Mine is TSC and yes I got the biometric appointment last time. Also good thing is that this time they have given the start date of from the expiration date of the current EAD.

However as I said im still waiting for my wife's EAD (efiled on the same day)

more...

house Clown: john wayne gacy jr.

Michael chertoff

05-04 07:19 PM

MC, I enjoy reading your posts, which, very often, are terse one-liners.

IMHO, you should have your CPO email before end of May. once you get it, don't go away, stay with us, here, on IV.

Thanks dummgelauft for your kindness. we need more people like you who are so kind and nice in this damn world .

You will get it soon too my friend. may be faster because you are a donor.

MC

IMHO, you should have your CPO email before end of May. once you get it, don't go away, stay with us, here, on IV.

Thanks dummgelauft for your kindness. we need more people like you who are so kind and nice in this damn world .

You will get it soon too my friend. may be faster because you are a donor.

MC

tattoo John+wayne+gacy+clown

blizkreeg

03-31 01:49 PM

Anyone still looking to share a room in DC? Or someone from the area offering a sleeping bag :) ?

more...

pictures John Wayne Gacy

amitjoey

01-18 05:27 PM

current membership is 8477. Thats awesome. New members, please use the invite your friends feature to invite more of your friends in similar situation.

dresses john wayne gacy clown.

gccovet

08-11 10:04 AM

Nothing on mine, Im still waiting

eFiled: May 23rd

Shantak,

when was your FP done?

Mine was paper based, but still waiting.:-(

GCCovet

eFiled: May 23rd

Shantak,

when was your FP done?

Mine was paper based, but still waiting.:-(

GCCovet

more...

makeup JOHN WAYNE GACY CLOWN PICTURES

raju123

02-06 02:43 PM

Numbersusa reported HR 2

http://www.numbersusa.com/index

Senate Minimum Wage Bill Avoided Immigration Increases

It has come to our attention that some believe that the dreadful McCain-Kennedy amnesty scheme was dropped into the bill during its passage through the Senate, but NumbersUSA�s analysis of that chamber�s proceedings indicates that those damaging provisions were not, in fact, amended into the measure before it was sent back to the House on February 1.

Sen. Ted Kennedy (D-MA) did propose an amendment to that effect, but it was neither substantively discussed nor adopted before passage of the underlying bill. In addition, Sen. Dianne Feinstein (D-CA) introduced and subsequently withdrew an amendment that would have provided amnesty to illegal alien farmworkers.

On the positive side, Sen. Jeff Sessions (R-AL) offered an amendment to H.R. 2, the Fair Minimum Wage Act of 2007, which would have dramatically increased civil fines on employers who hire illegal aliens. Sen. Sessions called it a �comprehensive wage reform� measure, playing off the �comprehensive immigration reform� term used by open borders advocates. He said his amendment was an appropriate addition to that particular measure � legislation designed to increase the wages of working Americans � because the salaries of low-skilled workers have lagged behind due to the large influx of illegal aliens.

Although Democratic leaders refused to let Sen. Sessions' initial amendment reach the Senate floor, a second Sessions proposal was adopted that day by a 94-0 vote. It would prohibit any government contractor caught using illegal labor from future government contracts for ten years. It is expected to face serious opposition by business and union lobbyists when the bill reaches conference committee.

Sen. Saxby Chambliss (R-GA) also introduced and withdrew a positive amendment that would have required that the employers of temporary unskilled foreign agricultural workers (H-2As) pay the greater of either the Federal minimum wage or a newly defined prevailing wage.

http://www.numbersusa.com/index

Senate Minimum Wage Bill Avoided Immigration Increases

It has come to our attention that some believe that the dreadful McCain-Kennedy amnesty scheme was dropped into the bill during its passage through the Senate, but NumbersUSA�s analysis of that chamber�s proceedings indicates that those damaging provisions were not, in fact, amended into the measure before it was sent back to the House on February 1.

Sen. Ted Kennedy (D-MA) did propose an amendment to that effect, but it was neither substantively discussed nor adopted before passage of the underlying bill. In addition, Sen. Dianne Feinstein (D-CA) introduced and subsequently withdrew an amendment that would have provided amnesty to illegal alien farmworkers.

On the positive side, Sen. Jeff Sessions (R-AL) offered an amendment to H.R. 2, the Fair Minimum Wage Act of 2007, which would have dramatically increased civil fines on employers who hire illegal aliens. Sen. Sessions called it a �comprehensive wage reform� measure, playing off the �comprehensive immigration reform� term used by open borders advocates. He said his amendment was an appropriate addition to that particular measure � legislation designed to increase the wages of working Americans � because the salaries of low-skilled workers have lagged behind due to the large influx of illegal aliens.

Although Democratic leaders refused to let Sen. Sessions' initial amendment reach the Senate floor, a second Sessions proposal was adopted that day by a 94-0 vote. It would prohibit any government contractor caught using illegal labor from future government contracts for ten years. It is expected to face serious opposition by business and union lobbyists when the bill reaches conference committee.

Sen. Saxby Chambliss (R-GA) also introduced and withdrew a positive amendment that would have required that the employers of temporary unskilled foreign agricultural workers (H-2As) pay the greater of either the Federal minimum wage or a newly defined prevailing wage.

girlfriend john wayne gacy art baseball. john wayne gacy art; john wayne gacy art

BharatPremi

10-15 03:36 PM

Thanks for your prompt reply! I think CP filers would be around 5%. Atleast in my organization, in July, 70 people filed 485 and I am the only CP applicant!

So you will be on H1 till conclusion. Best Luck.

So you will be on H1 till conclusion. Best Luck.

hairstyles John+wayne+gacy+clown john

raj2007

04-14 03:57 AM

GC is given for a period of 10 years and not for ever.

Permanent Resident Card

The Permanent Resident Card, Form I-551, is issued to all Permanent Residents as evidence of alien registration and their permanent status in the US. The card must be in your possession at all times. This requirement means that you are not only required to have a currently valid Form I-551 at all times, but also that you must carry your currently valid Form I-551 on your person at all times. The Permanent Resident Card currently is issued with a 10-year validity. You status as a Permanent Resident does not expire with the 10-year validity. Only the card expires. The card is only valid up to the expiration date and must be renewed before it expires.

source

http://www.uscis.gov/portal/site/uscis/menuitem.5af9bb95919f35e66f614176543f6d1a/?vgnextoid=fe17e6b0eb13d010VgnVCM10000048f3d6a1RCR D&vgnextchannel=4f719c7755cb9010VgnVCM10000045f3d6a1 RCRD

Permanent Resident Card

The Permanent Resident Card, Form I-551, is issued to all Permanent Residents as evidence of alien registration and their permanent status in the US. The card must be in your possession at all times. This requirement means that you are not only required to have a currently valid Form I-551 at all times, but also that you must carry your currently valid Form I-551 on your person at all times. The Permanent Resident Card currently is issued with a 10-year validity. You status as a Permanent Resident does not expire with the 10-year validity. Only the card expires. The card is only valid up to the expiration date and must be renewed before it expires.

source

http://www.uscis.gov/portal/site/uscis/menuitem.5af9bb95919f35e66f614176543f6d1a/?vgnextoid=fe17e6b0eb13d010VgnVCM10000048f3d6a1RCR D&vgnextchannel=4f719c7755cb9010VgnVCM10000045f3d6a1 RCRD

santb1975

04-07 04:37 PM

Please..Please sign up to be part of Team IV

tonyHK12

10-26 03:48 PM

Instead of starting afresh with a new bill, it would be wise if our lobbying efforts for legal immigration adjust to the changing political winds in Washington.

How Would a Republican Congress Handle Immigration? � The Washington Independent (http://washingtonindependent.com/101609/how-would-a-republican-congress-handle-immigration)

1. Based on the report above, the new heads of judiciary committee and Immigration Sub Committee are individuals who view "border security" as the first step towards Immigration Reform. Since a majority of members on this forum are LEGAL immigrants, we need not worry about any steps taken towards border security and ICE Enforcement.

...

...

5. Immigration Voice works with Patton Boggs to voice our concerns with the lawmakers. Former Senator/Congressman Trent Lott works with Patton Boggs. He was the house majority leader, Republican whip and is someone who has (or had) a lot of clout within the Republican party. He was a colleague of Rep. Lamar Smith. He might help us push for the legal immigration piece.[/B][/B]

Just my $0.02

I agree with you, I kind of like the way republicans have been handling immigration issues in general so far. I am in New York and we plan on meeting Senator Schumer too anyway.

We should support their border, ICE policies, but the current president has also set a record for deportations. I also kind of see where americans feel that a secure border and deportation is a priority and its good for every body. We are implicitly supporting, as some are paying 2000 extra for a visa to fund border security!!

The difference between advocacy and lobbying directly is just citizenship.

many of us forget that we are in one of the best functioning/largest democracies, no matter its defects.

Of course the end result is we need a change in law for this, no matter what, and the only way to do this is with a Bill.

I changed the subject of this thread from 'New Bill', but the title is still the old one. We can do this in other ways too, instead of a new one.

How Would a Republican Congress Handle Immigration? � The Washington Independent (http://washingtonindependent.com/101609/how-would-a-republican-congress-handle-immigration)

1. Based on the report above, the new heads of judiciary committee and Immigration Sub Committee are individuals who view "border security" as the first step towards Immigration Reform. Since a majority of members on this forum are LEGAL immigrants, we need not worry about any steps taken towards border security and ICE Enforcement.

...

...

5. Immigration Voice works with Patton Boggs to voice our concerns with the lawmakers. Former Senator/Congressman Trent Lott works with Patton Boggs. He was the house majority leader, Republican whip and is someone who has (or had) a lot of clout within the Republican party. He was a colleague of Rep. Lamar Smith. He might help us push for the legal immigration piece.[/B][/B]

Just my $0.02

I agree with you, I kind of like the way republicans have been handling immigration issues in general so far. I am in New York and we plan on meeting Senator Schumer too anyway.

We should support their border, ICE policies, but the current president has also set a record for deportations. I also kind of see where americans feel that a secure border and deportation is a priority and its good for every body. We are implicitly supporting, as some are paying 2000 extra for a visa to fund border security!!

The difference between advocacy and lobbying directly is just citizenship.

many of us forget that we are in one of the best functioning/largest democracies, no matter its defects.

Of course the end result is we need a change in law for this, no matter what, and the only way to do this is with a Bill.

I changed the subject of this thread from 'New Bill', but the title is still the old one. We can do this in other ways too, instead of a new one.

Source URL: http://cyclistatlarge.blogspot.com/2011/06/john-wayne-gacy-clown-costume.html

Visit amy winehouse for Daily Updated Hairstyles Collection